No. Because the emergency financial aid grant is not includible in your gross income, you cannot claim any deduction or credit for expenses paid with the grant including the tuition and fees deduction, the American Opportunity Credit, or the Lifetime Learning Credit. See section 139(h) of the Internal Revenue Code.

The 1098-T forms will be available by January 31st. Students will receive an email when the forms and detail are available on Howdy. For those students who chose paper delivery, the 1098-Ts will be mailed by January 31st.

If you've elected online delivery, a standard paper form will not be mailed.

Your 1098-T is available online via the Howdy Portal. Please follow these steps to retrieve your 1098-T:

- Log into Howdy.

- If you're a former student, go to the "Former Student" tab. Otherwise, go to the next step.

- In the search engine type keyword “1098”

- Click 1098T Tax Forms

- Click one of the links in the table to view the 1098-T and/or the Detail 1098-T information.

If you have trouble logging in or have forgotten your password:

- If you forgot your password and have set up Self-Service Password Reset, you can reset your password at Gateway's Password Reset page.

- If you forgot your NetID password and haven't set up your password security questions, first visit an Open Access Lab or Help Desk Central, or call (979) 845-8300, to have your account marked. After your account has been marked, if you are a student, applicant, employee or faculty member, set your new password at Gateway's Reset Forgotten Password.

- If you are a former student not enrolled in the past two years:

- Currently we do not have a system to recover your password, however you can fill out the Former Student Questionnaire to reactivate your UIN.

- If you are a Former Student who was enrolled in the past two years:

-

- Your Howdy account is still active. You will need to log in using your NetID and password. You do not need to create a separate former student account.

- If you forgot your NetID/password or it is expired, visit this page for help.

Box 1 of Form 1098-T reports the qualified tuition and related expenses paid during the calendar year. Qualified tuition and related expenses are sometimes referred to as qualified education expenses, although the terms are not always interchangeable. For purposes of the Form 1098-T provided by Texas A&M University, listed below is a partial list of qualified and unqualified expenses.

Qualified Tuition and Related Expenses

- Designated Tuition

- Tuition

- Library Access Fee

- Information Technology Fee

- Student Center Complex Fee

- Student Service Fee

- Lab Fee

- University Services Fee

- Scholarship Fee

- International Student Service Fee

Unqualified Expenses

- Room and Board Fee

- Book Vouchers

- Athletic Fee

- Student Health Fee

- Parking Fee

- Late Registration Fee

- Recreational Fee

- Nursing Liability Insurance

- International Sponsored Fee

The amount in box 1 of the 1098-T represents payments received for Qualified Tuition and Related Expenses (QTRE), not the total amount paid. Not all payments received are for Qualified Tuition and Related Expenses. For example, parking permit fees may appear on the bill statement, but it is not a Qualified Tuition and Related Expense. You will therefore see a difference in the payments received for Qualified Tuition and Related Expenses (1098-T Box 1) and the total amount paid.

Box 2 will be empty. The IRS has changed the reporting method, and at this time, Box 1 will be will contain the information that you need to complete your taxes.

The detail code descriptions on your 1098-T Detail provide a brief description of each transaction included in your 1098-T calculations.

To change the address noted on your 1098-T, please follow these steps:

- Log into the Howdy website

- Click on the "My Profile" tab

- Click Student Information (on the top of the screen)

- Click the Edit button by Bio Information

- Go to Address and click the Edit button

If a student chooses on-line delivery, no paper form will be mailed. If a student chooses paper delivery, the 1098-T is mailed to the permanent address by January 31st.

1098-T tax forms are available online at the Howdy Portal. Current and Former students can access the current year 1098-T form and detail, plus the 1098-T form and detail for the past two year. For example, in 2019, while you are preparing your 2018 taxes, the 2017 and 2016 1098-T forms are available for you to view and print.

To receive a duplicate 1098-T Form or Detail, the student must personally complete and sign a 1098-T Duplicate Request Form. Even when the parent/guardian has access to the student's tax information online, only the student can authorize a duplicate request, and the request form is required. Follow the instructions and complete the entire form. The most common delays are due to missing or incomplete information on the request form.

For prompt delivery:

- Include your UIN (not SSN) on the form

- Write legibly

- Include a current telephone number and email address

Texas A&M University is prohibited from giving tax advice, or guidance on tax determinations or calculations, and from disclosing any student information over the telephone or to anyone other than the individual student. We offer as much information as possible and include informative resources and references when available.

Instructions for students are printed on the 1098-T Tax form itself in order to answer some of your questions. Other resources, such as IRS Publication 970 or seeking the advice from a qualified tax professional, are recommended if you have questions about your specific reporting.

Click on the appropriate link under the Log In box on the Howdy homepage, or click on the box at the bottom of the homepage that applies to your problem. Follow the detailed instructions found at all of these separate links.

In order for a parent to view and download the 1098-T form from Howdy, your student must grant you specific access to Tax Form 1098-T and you must set up your own account. See the following FAQ for setting up your own account.

A parent should not try to access their child's 1098-T through the student's Howdy account.

Yes, but only with the student's direct consent and permission. Texas A&M is prohibited from discussing or disclosing any student information over the telephone or to anyone other than the student themselves. Only the student can grant a parent or guardian access to their online 1098-T by going to the Howdy Portal and granting this access. Exercising this option allows parents or guardians to view their student's tax information online.

In order for the student to grant this permission, students must follow the steps outlined on the Howdy homepage by selecting Information About Parent Guardian Access, and then choose Student, and follow the instructions for "Setting up Parent/Guardian Access to Academic Records, Financial Aid, Tax Forms and Other Services".

After the student grants access to the parent, then the parent must go to the Howdy Homepage, select Information About Parent/Guardian Access and click on Parent/Guardian and go to Parent/Guardian Access to Academic Records and Other Services – Howdy and follow the required instructions for setting up their own account.

Having access to pay the student's bill does not give the parent access to view the student's tax forms. The above steps must be completed to view the tax forms.

In situations where the student is away or inaccessible, gaining access to tax information presents a problem. Federal law prohibits the release of any information without the student's direct consent, even when the student is away for academics, research, or on official military orders.

First, plan ahead and have any required documents signed or have electronic access privileges in place before the student departs. Second, maintain contact with the student so he/she can be reached for direct verification. Finally, you may consider consulting with a legal professional to acquire a Power of Attorney (POA). The POA is the only circumstance where Texas A&M University is permitted to release tax information to parents or guardians.

Federal law requires and ensures privacy of information through the Family Educational Rights and Privacy Act (FERPA). Texas A&M University cannot disclose a student's financial or tax information to anyone over the telephone.

The 1098-T (along with the 1098-T Detail) provides tax information necessary to determine eligibility for the American Opportunity Credit and the Lifetime Learning Credit. These are two tax credits available to help offset the costs of higher education by reducing the amount of your income tax. See Publication 970 on the IRS website for further information.

You can download your 1098-E by logging into MyAggieLoans. If you have any questions concerning your 1098-E, please call (979) 847-3337, option 4.

It helps you identify eligible college expenses for valuable education credits. See this IRS document for more details.

See this IRS page for more details.

Electronic W-9S FAQs

Yes. International students that cannot supply a SSN or ITIN, must still complete the Howdy Tax ID request.

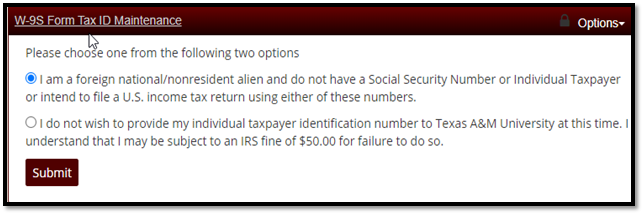

As Illustrated below you will need to select option one when completing the electronic W-9s Form.

"I am a foreign national nonresident alien and do not have an SSN or ITIN or intend to file a U.S. income tax using either of these numbers."

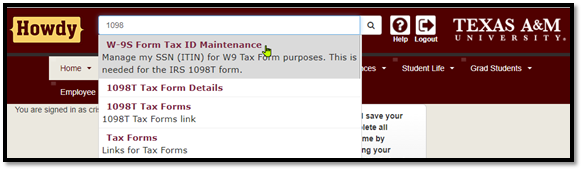

If a Notification does not appear, use the search bar to find the W-9S Form Tax ID maintenance page.

- In the search engine use keywords "1098", "Tax" or "W-9" to locate the maintenance page.

- Click the hyperlink "Click Here to Begin Process or For More Information" to get to the W-9S Form Tax ID maintenance page.

Form W-9S, Request for Student’s Taxpayer Identification Number and Certification, is used by eligible educational institutions to request the taxpayer identification number of students for whom the institution must report 1098-T Tuition Statement information to the Internal Revenue Service.

All students who have a missing or invalid social security number (SSN) in their student record, who were enrolled in credit-based courses and made payments during the tax year that are reportable on a 1098-T Tuition Statement will receive a W-9S, Request for Taxpayer Identification Number and Certification.

Section 6109 of the Internal Revenue Code requires taxpayers to give their correct social security number (SSN) or individual taxpayer identification number (ITIN) to entities who must file 1098-T Tuition Statement information returns. If the student has a taxpayer identification number (SSN or ITIN) and does not provide it when requested, the Internal Revenue Service (IRS) may fine the taxpayer $50.00. Because the IRS has a taxpayer identification number matching program that may be used to match Texas A&M University 1098-T Tuition Statement reporting to an income tax return claiming an education tax benefit, it may be advantageous for the student to provide their tax identification number. Please consult your tax advisor for more information. Taxpayers seeking advice regarding the risk of being fined for not providing their taxpayer identification number should consult their tax advisor. Ultimately, it is the student's decision whether or not to provide their taxpayer identification number. Texas A&M University will report a student's 1098-T information to the IRS with or without a taxpayer identification number.

An individual taxpayer identification number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). It is a nine-digit number that always begins with the number 9 and includes the following range: 900-70-0000 to 999-88-9999, 900-90-0000 to 999-92-9999, 900-94-0000 to 999-99-9999. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a social security number (SSN)from the Social Security Administration (SSA). ITINs are issued regardless of immigration status because both resident and nonresident aliens may have U.S. tax return and payment responsibilities under the Internal Revenue Code. Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN, unless they meet an exception.